A Spanish-speaking cybercrime group named GXC Crew has been noticed bundling phishing kits with malicious Android functions, taking malware-as-a-service (MaaS) choices to the following stage.

Singaporean cybersecurity firm Group-IB, which has been monitoring the e-crime actor since January 2023, described the crimeware resolution as a “refined AI-powered phishing-as-a-service platform” able to concentrating on customers of greater than 36 Spanish banks, governmental our bodies and 30 establishments worldwide.

The phishing equipment is priced wherever between $150 and $900 a month, whereas the bundle together with the phishing equipment and Android malware is on the market on a subscription foundation for about $500 per thirty days.

Targets of the marketing campaign embrace customers of Spanish monetary establishments, in addition to tax and governmental providers, e-commerce, banks, and cryptocurrency exchanges in america, the UK, Slovakia, and Brazil. As many as 288 phishing domains linked to the exercise have been recognized so far.

Additionally a part of the spectrum of providers supplied is the sale of stolen banking credentials and customized coding-for-hire schemes for different cybercriminal teams concentrating on banking, monetary, and cryptocurrency companies.

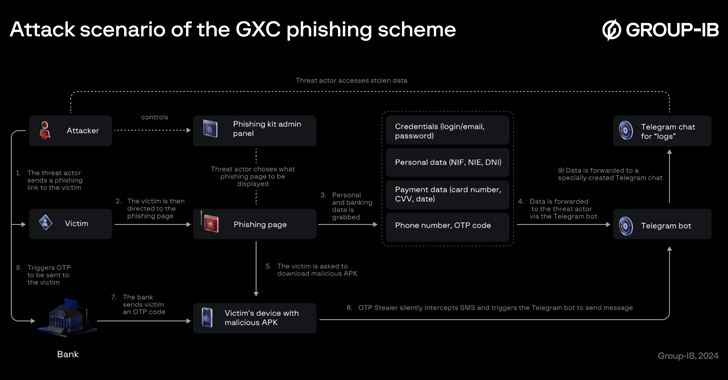

“In contrast to typical phishing builders, the GXC Crew mixed phishing kits along with an SMS OTP stealer malware pivoting a typical phishing assault state of affairs in a barely new route,” safety researchers Anton Ushakov and Martijn van den Berk stated in a Thursday report.

What’s notable right here is that the risk actors, as a substitute of immediately making use of a bogus web page to seize the credentials, urge the victims to obtain an Android-based banking app to forestall phishing assaults. These pages are distributed by way of smishing and different strategies.

As soon as put in, the app requests for permissions to be configured because the default SMS app, thereby making it potential to intercept one-time passwords and different messages and exfiltrate them to a Telegram bot beneath their management.

“Within the ultimate stage the app opens a real financial institution’s web site in WebView permitting customers to work together with it usually,” the researchers stated. “After that, at any time when the attacker triggers the OTP immediate, the Android malware silently receives and forwards SMS messages with OTP codes to the Telegram chat managed by the risk actor.”

Among the many different providers marketed by the risk actor on a devoted Telegram channel are AI-infused voice calling instruments that enable its clients to generate voice calls to potential targets primarily based on a sequence of prompts immediately from the phishing equipment.

These calls sometimes masquerade as originating from a financial institution, instructing them to supply their two-factor authentication (2FA) codes, set up malicious apps, or carry out different arbitrary actions.

“Using this straightforward but efficient mechanism enhances the rip-off state of affairs much more convincing to their victims, and demonstrates how quickly and simply AI instruments are adopted and carried out by criminals of their schemes, remodeling conventional fraud situations into new, extra refined techniques,” the researchers identified.

In a current report, Google-owned Mandiant revealed how AI-powered voice cloning have the potential to imitate human speech with “uncanny precision,” thus permitting for extra authentic-sounding phishing (or vishing) schemes that facilitate preliminary entry, privilege escalation, and lateral motion.

“Menace actors can impersonate executives, colleagues, and even IT assist personnel to trick victims into revealing confidential info, granting distant entry to programs, or transferring funds,” the risk intelligence agency stated.

“The inherent belief related to a well-known voice may be exploited to govern victims into taking actions they might not usually take, similar to clicking on malicious hyperlinks, downloading malware, or divulging delicate information.”

Phishing kits, which additionally include adversary-in-the-middle (AiTM) capabilities, have turn into more and more in style as they decrease the technical barrier to entry for pulling off phishing campaigns at scale.

Safety researcher mr.d0x, in a report revealed final month, stated it is potential for dangerous actors to make the most of progressive internet apps (PWAs) to design convincing login pages for phishing functions by manipulating the consumer interface components to show a faux URL bar.

What’s extra, such AiTM phishing kits may also be used to interrupt into accounts protected by passkeys on varied on-line platforms by way of what’s known as an authentication methodology redaction assault, which takes benefit of the truth that these providers nonetheless provide a less-secure authentication methodology as a fallback mechanism even when passkeys have been configured.

“Because the AitM can manipulate the view offered to the consumer by modifying HTML, CSS and pictures or JavaScript within the login web page, as it’s proxied by way of to the top consumer, they’ll management the authentication circulation and take away all references to passkey authentication,” cybersecurity firm eSentire stated.

The disclosure comes amid a current surge in phishing campaigns embedding URLs which might be already encoded utilizing safety instruments similar to Safe Electronic mail Gateways (SEGs) in an try to masks phishing hyperlinks and evade scanning, based on Barracuda Networks and Cofense.

Social engineering assaults have additionally been noticed resorting to uncommon strategies whereby customers are enticed into visiting seemingly authentic web sites and are then requested to manually copy, paste, and execute obfuscated code right into a PowerShell terminal beneath the guise of fixing points with viewing content material in an online browser.

Particulars of the malware supply methodology have been beforehand documented by ReliaQuest and Proofpoint. McAfee Labs is monitoring the exercise beneath the moniker ClickFix.

“By embedding Base64-encoded scripts inside seemingly authentic error prompts, attackers deceive customers into performing a sequence of actions that end result within the execution of malicious PowerShell instructions,” researchers Yashvi Shah and Vignesh Dhatchanamoorthy stated.

“These instructions sometimes obtain and execute payloads, similar to HTA information, from distant servers, subsequently deploying malware like DarkGate and Lumma Stealer.”