Colorado firms that promote items imported from abroad had been hammered throughout Thursday’s inventory market plunge, which was the worst one-day drop seen within the U.S. since pandemic fears roiled traders on March 16, 2020.

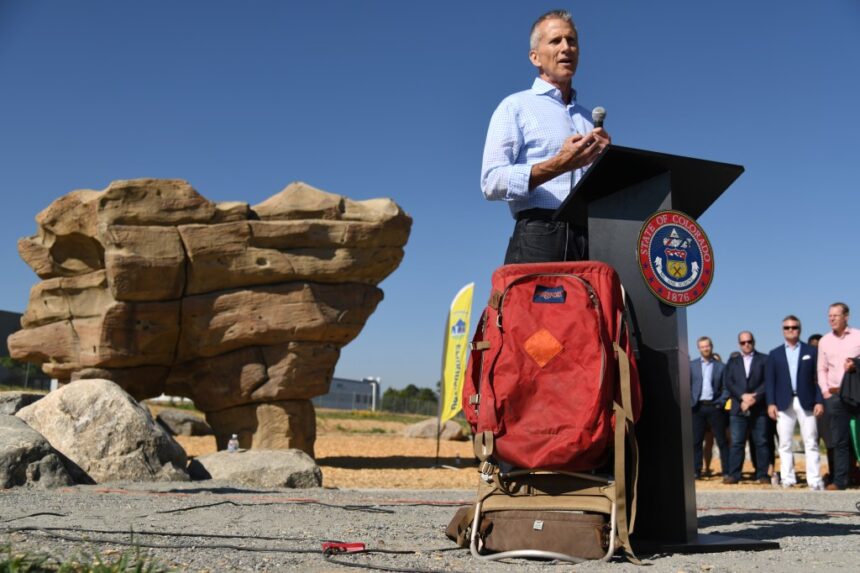

Denver-based VF Corp., proprietor of a number of iconic manufacturers like The North Face and Vans, misplaced 28.7% of its market worth on Thursday, making it one of many hardest hit shares within the nation. VF shares suffered their largest one-day drop since Oct. 19, 1987, also referred to as Black Monday, once they fell 26.1%.

VF shares reached a 52-week excessive of $29.02 on Jan. 29, reflecting a rebound in an organization that had as soon as traded within the $80 vary 4 years earlier. Shares of the attire retailer, nonetheless, got here below strain when the Trump administration started proposing widespread tariffs. The day after particulars got here out on Wednesday, shares dropped $4.71 to $11.68, erasing $2.57 billion in market worth.

Broomfield-based Crocs, one other attire model that imports a lot of its merchandise from abroad, suffered a virtually 14% loss in its share worth, akin to the share loss suffered by Deckers Out of doors, maker of Ugg boots and Hoka trainers, and Nike.

About 1% of footwear and a couple of.5% of the clothes bought within the U.S. is made domestically, with China and Vietnam key sources of these gadgets, in response to the funding agency Jefferies.

Chinese language-made items face tariffs of 34%, which comes on prime of 20% tariffs introduced earlier this yr. Vietnamese items face a 46% hit, among the many highest levied on Wednesday. Through the first Trump administration, some firms tried to get round larger tariffs on Chinese language items by shifting manufacturing to Vietnam, however that strategy received’t work this time round, nor will shifting manufacturing to Mexico.

Denver-based Gates Industrial Corp., initially made well-known for its rubber fan belts and radiator hoses, depends closely on abroad crops for its broad array of merchandise. Shares in that firm dropped 12.2% to $16.88.

Shares of Centennial-based Arrow Electronics, which distributes electronics and different elements imported from across the globe, dropped $9.05 or 8.6% to shut Thursday at $96.11, which represents a brand new 52-week low.

Denver-based Palantir, Colorado’s largest public firm with a market worth of $205 billion, noticed its share worth fall $3.85 to $83.60, which represents a 4.4% decline. Even with that drop, shares within the firm stay 4 instances larger than they had been a yr in the past.

Canmaker Ball Corp. noticed its shares drop 3.46% on Thursday. The Westminster firm relies upon closely on imported aluminum and its shares had been hit more durable when a separate 25% tariff on aluminum imports was introduced on Feb. 10.

Oil and gasoline firms additionally noticed their shares fall on considerations of decreased consumption as a result of a possible recession and better manufacturing targets that OPEC introduced. Denver-based Civitas Assets noticed its shares plunge 16.4%, whereas Houston-based EOG Assets, which has a big workplace in Denver, noticed its shares fall 7.76%. Denver-based Liberty Vitality, a area help providers agency based by present Division of Vitality Secretary Chris Wright, noticed its worth minimize by 18.4%.

Not each Colorado inventory was down on Thursday. Greeley-based Pilgrim’s Pleasure, which exports its rooster and turkey merchandise internationally, noticed its shares rise 4.2% to $51.06, hitting a 52-week excessive.

The tariffs introduced on Wednesday are anticipated to generate $438 billion and $512 billion in income for the U.S. authorities, assuming present ranges of imports and buying maintain up. The quantity that U.S. inventory markets misplaced in response to these further tariffs was round $3.1 trillion on Thursday, in response to The Wall Road Journal.

Get extra enterprise information by signing up for our Financial system Now publication.

Initially Revealed: