Picture supply: Getty Pictures

Is Tesla (NASDAQ:TSLA) inventory undervalued? Nicely, it’s laborious to argue that any firm buying and selling at 100 occasions ahead earnings is undervalued. In truth, a lot of the charts would reinforce that. The inventory is exceedingly costly.

Right here’s what the charts say

Beginning with the price-to-sales (P/S) ratio, we are able to see that Tesla has been costlier, and it’s additionally been cheaper over the previous 5 years. As the information highlights, Tesla is at the moment buying and selling round 33% above its lowest P/S ratio throughout the interval. Nonetheless, the low cost versus 2021 ranges is large.

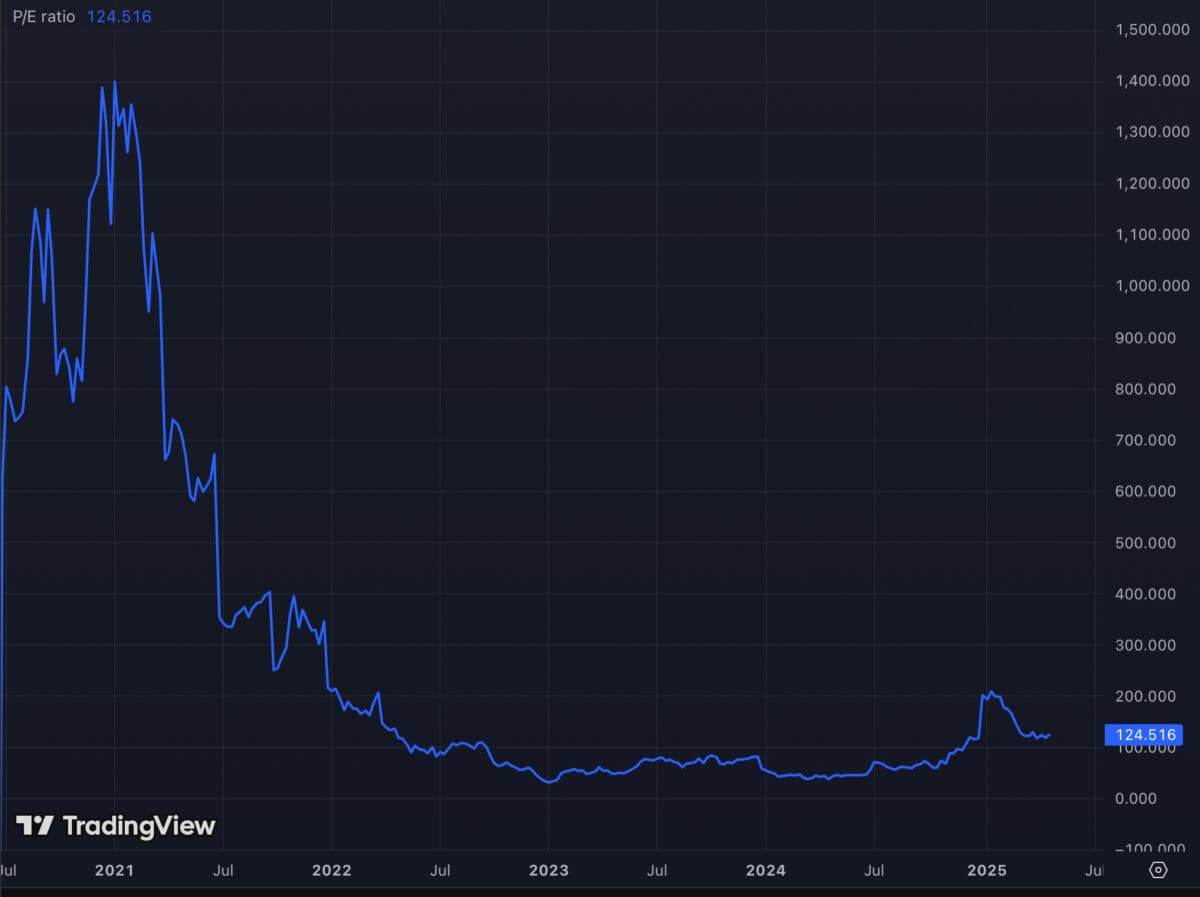

The value-to-earnings (P/E) ratio exhibits an identical image. Firstly, we are able to see that at 124 occasions trailing earnings, it’s extremely costly for a automotive inventory. Nonetheless, it has been considerably costlier than it’s as we speak.

What’s extra, the anticipated earnings progress price from right here does little to fulfill this valuation. Analysts anticipate earnings to develop by round 11.5% yearly over the medium time period. That’s slower than usually ‘boring’ British firms like Lloyds. The result’s a P/E-to-growth (PEG) ratio of eight. For context, truthful worth is taken into account to be one and below.

All of this means Tesla inventory ought to collapse.

A multi-trillion greenback promise

So, why is Tesla so costly? Nicely, Elon Musk has repeatedly asserted that Tesla might turn out to be essentially the most beneficial firm on the planet, even surpassing the mixed market capitalisation of as we speak’s 5 largest companies. Collectively, these firms are price round $11trn. Musk’s imaginative and prescient hinges on transformative applied sciences past electrical automobiles and into autonomous robotaxis and humanoid robots.

Tesla’s future is centred on full self-driving automobiles and the creation of an enormous robotaxi fleet. This ride-hailing community might function across the clock, producing steady income and probably disrupting each the automotive and transportation sectors. Analysts reminiscent of ARK Funding Administration’s Cathie Wooden estimate the robotaxi alternative alone may very well be price as much as $14trn by 2027.

As well as, these robotaxis might, in principle, promote their unused computing energy to the broader market when not in operation. In any case, these automobiles would require a few of the most superior computing know-how round. “So should you can think about the long run, maybe the place there’s a fleet of 100m Teslas, and on common, they’ve received like perhaps a kilowatt of inference compute. That’s 100 gigawatts of inference compute distributed all world wide”, Musk mentioned in 2024.

Musk can also be betting on Tesla Optimus, a humanoid robotic he claims might finally outpace the automotive enterprise in worth. He envisions tens of millions of those robots produced yearly, serving in factories and houses, and forecasts that Optimus might generate over $10trn in income as adoption scales. These robots would additionally play an vital position in his plan to colonise Mars.

Nonetheless, coming again all the way down to earth with a bang, there are large execution dangers. Tesla is behind a few of its robotaxi friends and Optimus has but to actually seize the creativeness of the investor. I wish to see Tesla proceed to push technological boundaries, however I can’t put my cash behind it but.