Picture supply: Aston Martin

I’m searching for one of the best bargains to purchase following current share value turbulence. After performing some preliminary analysis, plainly Aston Martin Lagonda‘s (LSE:AML) share value might warrant an in depth look.

At 61.3p per share, the FTSE 250 inventory’s dropped greater than 1 / 4 in worth over the previous month, and 61.6% over a one-year horizon.

Aston’s not tipped to generate any income over the following couple of years. So the price-to-earnings (P/E) ratio doesn’t give us an thought about whether or not its shares supply respectable worth for cash.

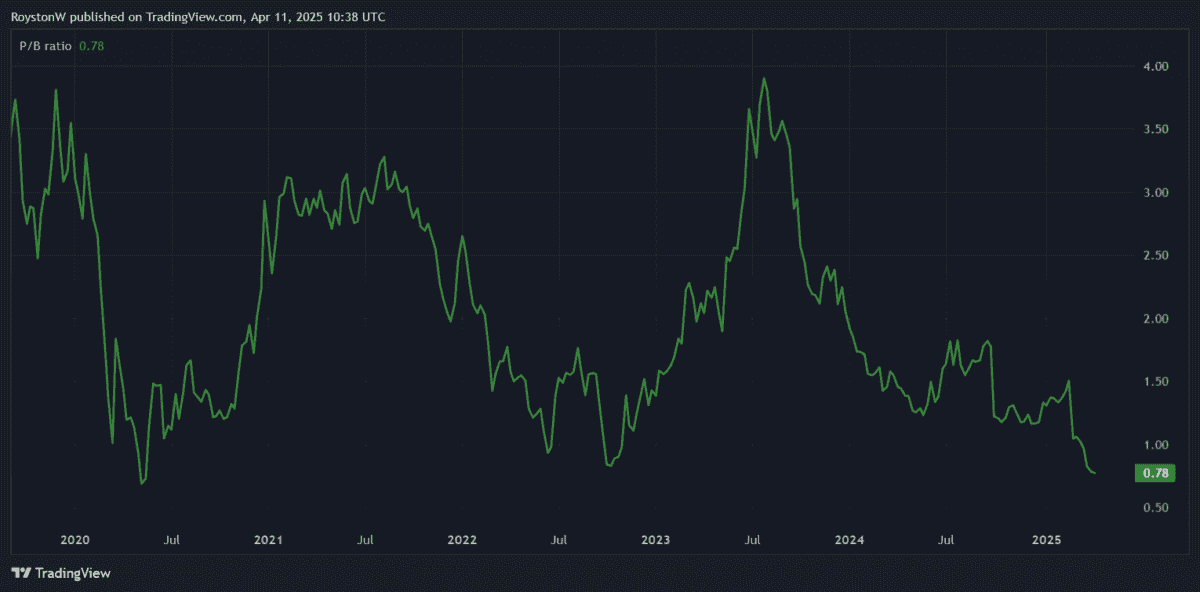

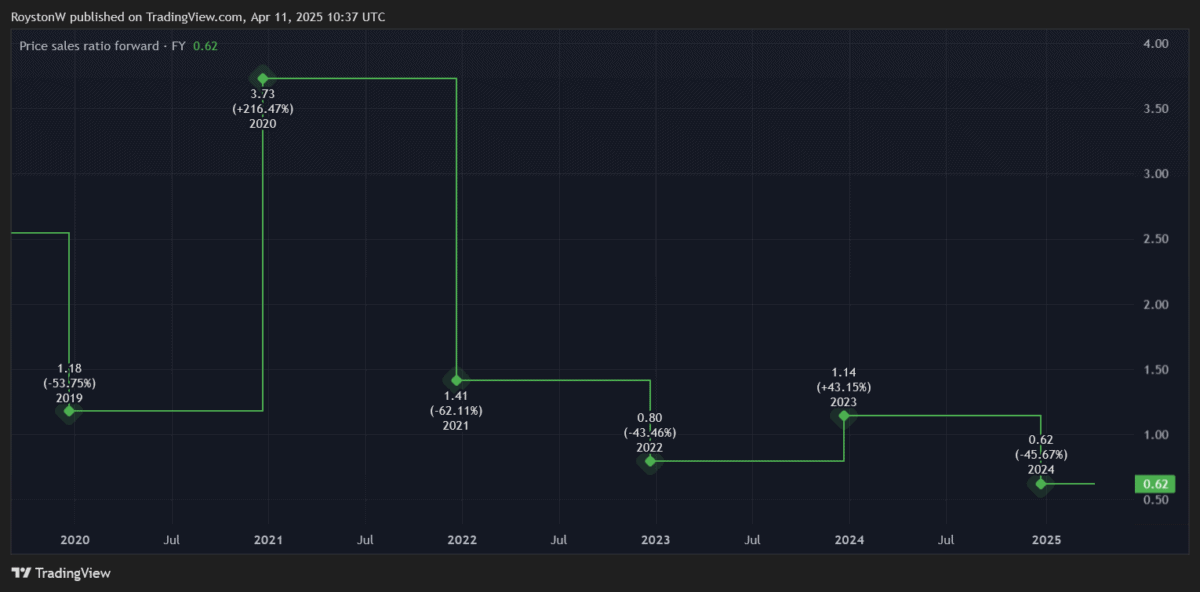

The value-to-book (P/B) a number of and price-to-earnings-to-growth (PEG) ratios, alternatively, do. As you possibly can see, each of those metrics fall effectively inside worth territory of 1 and under:

Nonetheless, it’s essential to think about that Aston’s low valuation might mirror the extent of threat it poses to traders. So what’s the story, and may invidividuals contemplate shopping for the enterprise at in the present day’s value?

Bumps within the street

Few carmakers on the planet have the lasting attraction that Aston Martin enjoys. Providing a tasty mixture of luxurious and pace, its merchandise are among the many hottest standing symbols on the market. And because the variety of world millionaires quickly grows, turnover might skyrocket if the corporate finds the suitable formulation.

But whereas Aston’s merchandise might glisten, the identical can’t be stated for the enterprise itself. Provide and manufacturing points, product improvement delays, a merry-go-round of CEOs, and excessive debt (web debt was £1.2bn in December) have left the Warwickshire agency in dire straits.

It’s additionally presently failing to succeed in clients within the extremely aggressive sports activities automotive market as successfully as different prestigious marques like Ferrari proper now.

Worrying readacross

Aston’s process isn’t made any simpler because the robust financial atmosphere crushes demand for costly automobiles. Competitor Porsche‘s first-quarter replace on Tuesday (8 April) underlined the massive challenges that high-end producers presently face.

This confirmed gross sales in Europe and Asia fall sharply in quarter one, with gross sales in China — a key marketplace for Aston — down 42% 12 months on 12 months.

US gross sales rose 37%, however this mirrored artifically low gross sales in Q1 2024 when models have been held at US ports as a result of part points. Even factoring this in, Porsche’s worldwide gross sales dropped 8% within the final quarter.

With the vital markets of China and the US embroiled in a fierce commerce struggle, and the spectre of import taxes weighing on different areas, issues might worsen for the carmakers earlier than they get higher. Aston’s personal gross sales volumes dropped 9% in 2024, newest financials confirmed.

The specter of a 25% tariff on US auto imports presents a extra particular threat for the corporate, too.

Longer-term threats

In one other worrying omen for Aston Martin, Porsche introduced a considerable pickup in electrical car (EV) gross sales in that first-quarter assertion. Some 38.5% of all models that rolled out of showrooms have been both absolutely electrical or hybrid fashions.

That is vital as a result of Aston has delayed the deliberate launch of its personal EVs by three years, to 2030. By counting on combustion engine automobiles within the meantime, it dangers shedding relevance in an more and more eco-conscious market.

And it’s, in my view, one other damning indictment of Aston’s turnaround technique. Whereas its automobiles nonetheless sparkle, I believe traders ought to contemplate avoiding Aston Martin shares regardless of their present cheapness.