Picture supply: Getty Pictures

The Santa Rally of early December now appears an extended, very long time in the past. At this time, inventory markets are awash with a sea of crimson, with some predicting {that a} US inventory market crash might be across the nook.

So what’s happening? And what motion ought to buyers like me take?

Right here’s what’s occurred

Hopes of swingeing rate of interest cuts in 2024 and 2025 have boosted world share markets this 12 months. Base fee reductions present an financial stimulus and produce down borrowing prices, boosting company profitability.

However stickier inflation extra just lately suggests these excessive fee reductions is probably not on the horizon in spite of everything. Such suspicions have exploded following the US Federal Reserve’s newest assembly yesterday (18 December).

As anticipated, the central financial institution lower its benchmark fee once more, to 4.25% from 4.5%. However Fed chairman Jerome Powell warned that “from this level ahead, it’s applicable to maneuver cautiously and search for progress on inflation.”

By including that inflation might take “one other 12 months or two” to get to the financial institution’s 2% goal, greater rates of interest could final for much longer than had been hoped.

What subsequent?

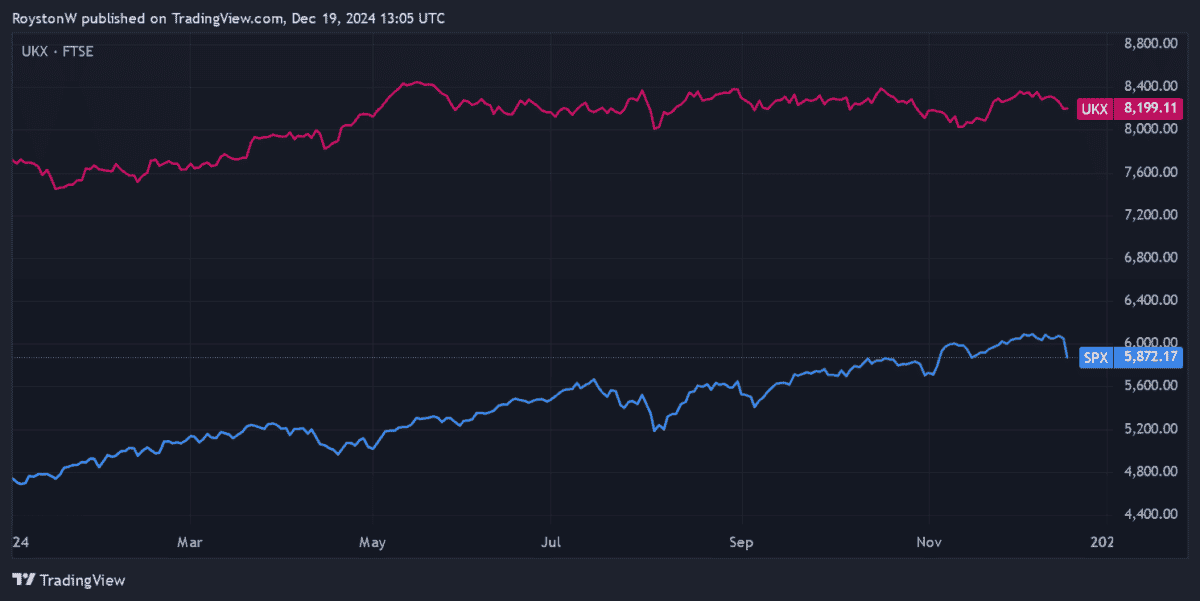

Inventory markets have plunged throughout the globe consequently. In London, the FTSE 100 slumped to one-month lows simply above 8,000 factors in the present day. Yesterday, the S&P 500 index of US shares dropped to six-week troughs.

Since earlier rallies have been constructed on expectations of fee cuts, these retracements are usually not stunning. Even after the wipeout of the final 24 hours, the S&P 500 stays up 23% within the 12 months thus far.

Might this be the start of a massacre? Many analysts say world shares are overvalued given issues like China’s struggling economic system, potential new commerce tariffs, and people indicators of persistent inflation.

On this context, additional falls might be across the nook.

That is my plan

Appropriately guessing how share markets will behave within the close to time period is a really powerful activity. At any given time, inventory costs are affected by a variety of macroeconomic and geopolitical components. Surprises also can spring up that shake asset values, as we’ve simply seen.

My guess is {that a} market crash is unlikely. However as I say, I can in no way make sure.

However whether or not the near-term outlook is dangerous or good, my very own investing technique stays the identical. Market turbulence is frequent, but share investing nonetheless delivers spectacular long-term returns. So decreasing my share holdings makes little to no sense.

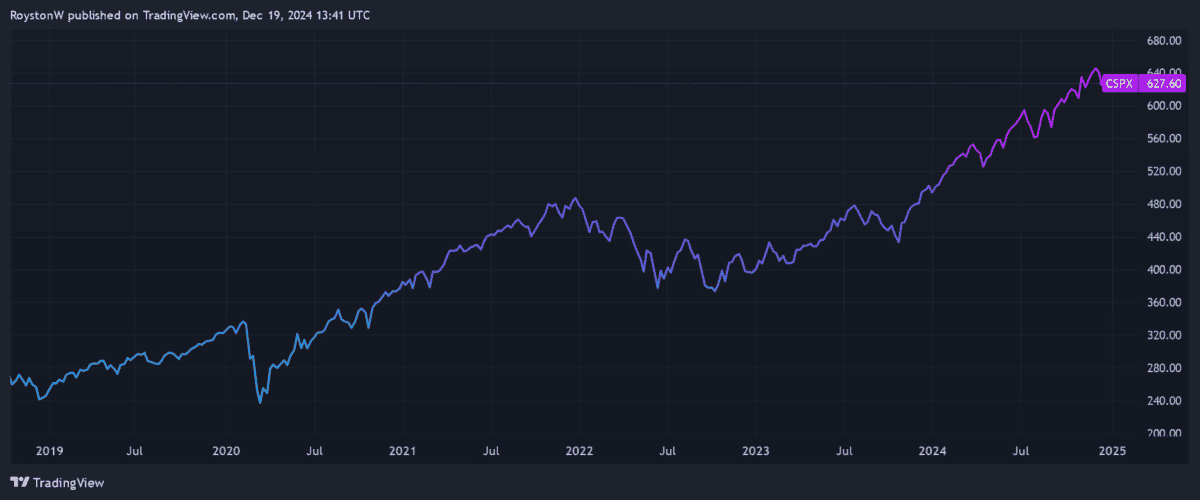

The S&P 500, as an example, has supplied a median annual return of 12.7% over the previous decade. It’s delivered these whopping returns regardless of issues just like the Covid-19 pandemic, rising geopolitical tensions and better rates of interest.

At occasions like these, I subsequently search for beaten-down shares, funds and trusts to purchase. And the iShares S&P 500 ETF (LSE:CSPX) is one I’m contemplating shopping for extra of following the index’s sharp drop.

Because the title implies, it offers me publicity to the whole S&P 500, which helps me to unfold danger. Having mentioned that, it additionally has appreciable progress potential as a result of its excessive weighting of tech shares together with Nvidia and Microsoft.

With an ongoing cost of 0.07%, it’s probably the most cost-effective funds monitoring the US index too.

Previous efficiency isn’t a dependable information of future returns. But when this iShares fund’s long-term return stays unchanged, a £10k funding in the present day would greater than triple to £36,365 a decade from now.