- RSI at the moment at 67.13, nearing overbought ranges.

- Superior Oscillator flipped optimistic for the primary time since January.

- FLR broke previous resistance at $0.016.

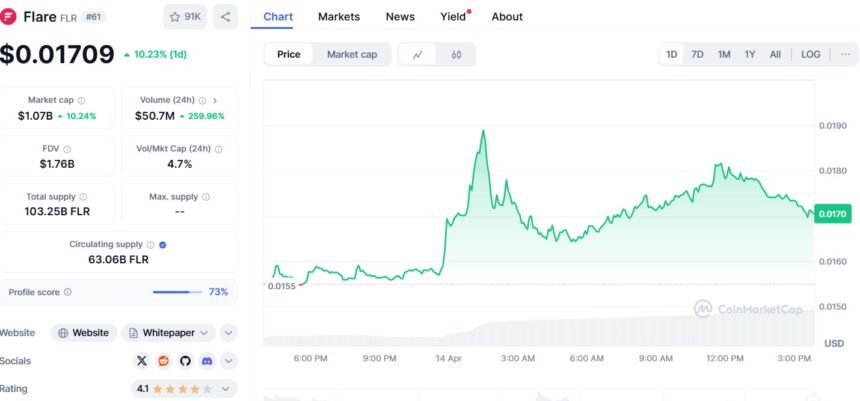

Flare (FLR) has emerged as one of many strongest performers within the altcoin market this week, surging by 57% over the previous seven days to hit a brand new native excessive of $0.018, buying and selling at $0.017 on the time of writing.

Supply: CoinMarketCap

The transfer marks a continued bullish rally that started on April 9, with FLR recording new every day highs every day since.

Key technical indicators just like the Relative Power Index (RSI) and Superior Oscillator (AO) now recommend that robust shopping for exercise continues to outpace promoting strain.

Nevertheless, with RSI ranges approaching overbought territory, analysts warn {that a} pullback could also be on the horizon if profit-taking intensifies.

RSI at 67 reveals robust shopping for development

Flare’s Relative Power Index stands at 67.13 on the time of writing, nearing the important thing 70 mark that sometimes indicators overbought situations.

The RSI indicator tracks momentum by evaluating the magnitude of latest good points and losses over a set interval, on a scale of 0 to 100. An RSI above 70 typically means that an asset might be overbought and should right quickly, whereas values under 30 point out the alternative.

FLR’s upward-trending RSI means that consumers are at the moment dominating the market, reflecting sustained curiosity within the asset. Whereas it has not but crossed the 70 threshold, the current worth signifies that FLR is nearing a possible inflection level.

If present momentum continues, the RSI could quickly verify an overbought sign, rising the probability of a short-term worth dip.

AO flips optimistic for the primary time in 2 months

Including to the bullish sentiment, Flare’s Superior Oscillator has turned optimistic for the primary time since January 26.

The AO contains histogram bars that measure the distinction between a 5-period and 34-period easy shifting common, offering perception into market developments and reversals.

The bars lately flipped above the zero line and have continued to develop in top, signalling a rise in optimistic market momentum.

When AO bars transfer above zero, it sometimes factors to a strengthening development. In FLR’s case, the constant development in these bars implies bullish conviction is constructing throughout the market.

This technical growth helps the concept that FLR’s latest good points usually are not simply short-term spikes, however a part of a broader uptrend pushed by enhancing investor sentiment.

Value breaks previous $0.016 resistance, eyes $0.021

FLR’s latest rally noticed it break by means of the resistance degree at $0.016, a worth level that had beforehand capped upward motion. Sustaining above this degree is seen as a essential consider figuring out whether or not the rally can prolong.

If $0.016 holds as a brand new help, analysts recommend the altcoin might rise additional to check the subsequent key resistance at $0.021. Nevertheless, the potential of near-term profit-taking might problem this bullish projection.

A renewed wave of promoting strain may push FLR again under $0.016 and in the direction of $0.010, particularly if RSI crosses into overbought territory and market individuals search to lock in good points.

Technical indicators help short-term good points

General, technical indicators for FLR stay largely optimistic. The mixture of a rising RSI, optimistic AO crossover, and breakout above earlier resistance ranges factors to continued bullish momentum within the brief time period.

Nevertheless, merchants are suggested to watch the RSI carefully. A transfer previous 70 might point out {that a} correction is due, particularly if quantity begins to fall or candlestick patterns recommend hesitation amongst consumers.

At this stage, FLR’s capability to consolidate above $0.016 will doubtless decide the subsequent part of its worth motion.

The submit Flare (FLR) surges 57% in per week as technicals flash overbought appeared first on CoinJournal.