In an interview with Yahoo Finance, US Senator Cynthia Lummis of Wyoming outlined a proposal to grant the Federal Reserve the authority to carry Bitcoin as a part of the USA’ official reserves. She argues that this method might enhance the nation’s long-term monetary stability, strengthen the worldwide function of the US greenback, and supply a helpful hedge in opposition to the nation’s ballooning nationwide debt, which now surpasses 36 trillion {dollars}.

Authority To Personal Bitcoin

“My proposal would have the US buy, by different property it already owns, 200,000 BTC a yr for 5 years, for a complete of 1,000,000,” Lummis reiterated her plans. “We might maintain it for a minimum of 20 years, and on the numbers that we venture that may accrue a fund that’s value about 16 trillion {dollars}. We wish our federal authorities to have a Strategic Bitcoin Reserve (SBR) that may assist again the US greenback, the world reserve forex, after which function a long-term financial savings account, thereby offsetting our nationwide debt.”

The senator’s remarks straight confront the present stance of Federal Reserve Chair Jerome Powell. On the newest Federal Open Market Committee press convention, Powell reiterated that the Federal Reserve Act restricts the establishment from proudly owning it. “We’re not allowed to personal Bitcoin. The Federal Reserve Act says what we will’t personal [it], and we’re not on the lookout for a regulation change. That’s the form of factor for Congress to think about, however we aren’t on the lookout for a regulation change on the Fed,” Powell remarked on Wednesday.

Lummis acknowledged this authorized roadblock however remained decided to shift the dialog in Congress. She believes lawmakers want to offer the central financial institution the authority to carry Bitcoin. “I perceive the Federal Reserve believes it doesn’t have the authorized authority to personal Bitcoin,” Lummis stated. “We have to give that to them. The Bitcoin the US already owns, roughly 200,000 Bitcoin, are throughout the asset forfeiture fund, and it’s necessary I believe that we take that fund, scoop it over right into a strategic Bitcoin reserve, after which add to it.”

Her proposal aligns with ideas set forth within the Bitcoin Act of 2024, launched earlier this yr. It seeks to ascertain a SBR within the US to reinforce the nationwide monetary technique. The Act includes organising safe BTC storage services, buying 1 million BTC over 5 years, and funding these purchases by current monetary reserves with out growing taxpayer burden.

“It completely is the fitting asset,” she stated, describing BTC’s properties. “It’s digital gold. It’s a finite supply—solely 21 million BTC will ever be mined. Though it’s barely risky, it’s at all times risky in an upward leaning course, and so the objective right here of holding it for 20 years is in recognition that on the brief time period, there may be short-term volatility. In the long run, there may be long-term development that far exceeds the power of the US greenback to maintain up.”

Lummis cited historic development traits to bolster her argument. Though Bitcoin has existed for under 15 years, she views its long-term trajectory as overwhelmingly constructive. Whereas she acknowledges that development might gradual from the early years—declining from 55% annual development to figures like 45% or 35%—it might nonetheless, in her estimation, “proceed to develop, the place the US greenback will proceed to say no in worth.” She sees in these figures a bulwark in opposition to the inexorable erosion of buying energy that comes with a forex intentionally managed to supply regular inflation.

🇺🇸 Senator Lummis says she needs to offer the Federal Reserve the authority to personal Bitcoin.

“I need our federal authorities to have a Strategic Bitcoin Reserve – shopping for 200,000 $BTC a yr for five years, and holding it for 20 years.” pic.twitter.com/g0nVZWKtK7

— Bitcoin Archive (@BTC_Archive) December 19, 2024

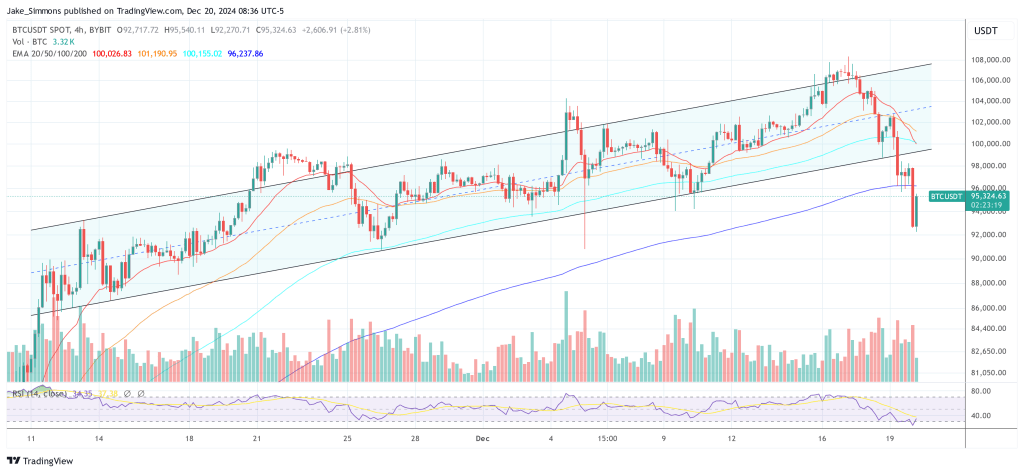

At press time, BTC traded at $95,324.

Featured picture from Wyoming Public Radio, chart from TradingView.com