The Revenue Tax Appellate Tribunal (ITAT) in Jodhpur, India, has at the moment clarified the taxation of crypto transactions performed earlier than the monetary 12 months (FY) 2022-2023. In line with the ruling, income from all such transactions will likely be handled as capital beneficial properties.

ITAT Provides Readability On Pre-2022 Crypto Taxation

In what is taken into account a landmark ruling for India’s digital belongings ecosystem, the ITAT declared that cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others, have been capital belongings earlier than April 1, 2022. Consequently, any income earned from their sale throughout that interval must be categorized as capital beneficial properties relatively than earnings from different sources.

For the uninitiated, India’s present digital belongings taxation framework got here into impact on April 1, 2022, as a part of Digital Digital Property (VDA) rules. These guidelines impose a flat 30% tax charge on all crypto beneficial properties with out permitting taxpayers to offset losses towards beneficial properties. Moreover, a 1% tax deductible at supply (TDS) is levied on each crypto transaction.

Nonetheless, ITAT’s resolution provides some reduction to early Indian cryptocurrency adopters, as they are going to be topic to a decrease tax charge than the flat 30% charge imposed underneath the present framework. Particularly, earlier than April 1, 2022, short-term capital beneficial properties have been taxed at 15%, whereas long-term capital beneficial properties have been taxed at 10%.

The ITAT’s resolution got here whereas listening to a case involving a person who had bought BTC value $6,478 in FY 2015-16 and bought it for $78,803 in FY 2020-21. The person argued that the proceeds from the sale must be taxed as long-term capital beneficial properties for the reason that asset was held for greater than three years. Nonetheless, the assessing tax officer disagreed, contending that digital belongings belongings, missing intrinsic worth, couldn’t be categorised as property.

In distinction, the ITAT dismissed the tax officer’s argument, stating that underneath Part 2(14) of the Revenue Tax Act, cryptocurrency qualifies as property. The tribunal clarified that “property of any sort held by an assessee,” together with a proper or declare over an asset, satisfies the definition of a capital asset.

India’s Regulatory Hole In Digital Property

Regardless of boasting the highest crypto adoption charge globally, India continues to lag in making a supportive regulatory framework for digital belongings. Because of this, quite a few digital belongings companies have relocated their headquarters to extra crypto-friendly jurisdictions such because the UAE or Singapore.

India’s excessive tax regime – 30% on beneficial properties and 1% TDS on transactions – has been a frequent goal of criticism. Final 12 months, the previous CEO of WazirX digital belongings change predicted that the present tax construction would stay in place for not less than two extra years earlier than any important revisions.

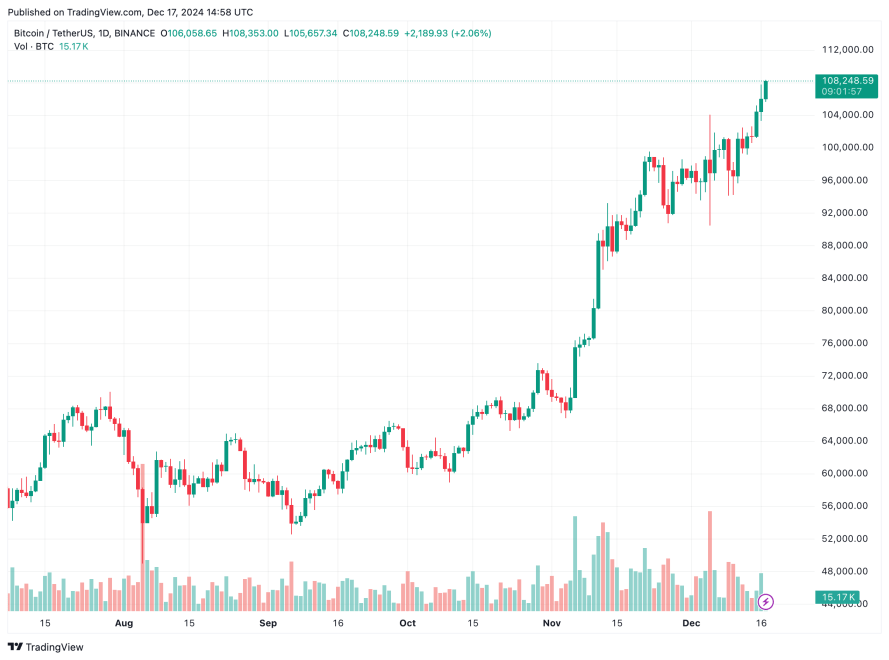

The Indian authorities is contemplating consultations with trade consultants to form a balanced regulatory framework for cryptocurrencies. BTC is buying and selling at $108,248 at press time, up 2.5% up to now 24 hours.

Featured Picture from Unsplash.com, Chart from TradingView.com