Colorado’s housing market remained stagnant by November.

Though lively stock and total provide elevated through the summer season and fall, rising rates of interest and costs saved many potential patrons off the market, in response to the November Market Tendencies Housing Report from the Colorado Affiliation of Realtors.

Kelly Moye of Compass stated the result’s “lackluster gross sales, flat costs, and sluggish purchaser demand. ”

“The hopeful expectation that one thing higher is across the nook, whether or not or not it’s decrease rates of interest or extra houses in the marketplace, has lulled patrons and sellers into inactivity,” she stated.

‘Wait and see’

Cooper Thayer, a dealer affiliate with the Thayer Group in Fortress Rock, stated patrons proceed to attend for a market change.

“Consumers and sellers who took the ready method with the election have now discovered new causes to ‘wait and see,’ because the election (unsurprisingly) didn’t actually influence the true property market,” he stated.

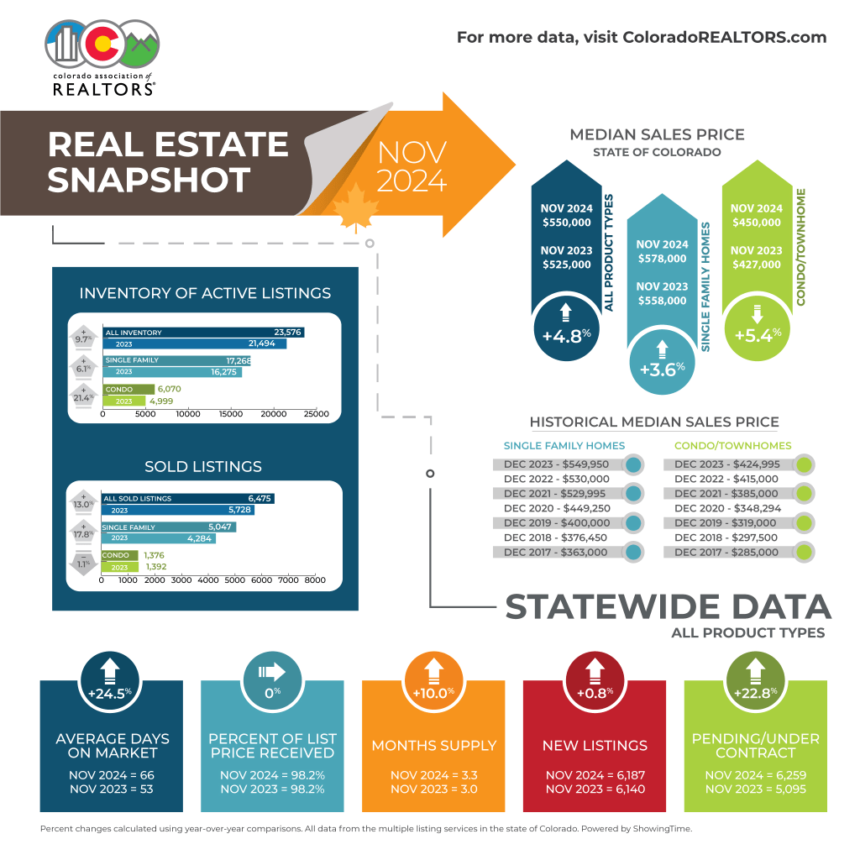

Statewide, new listings for single-family houses dropped greater than 38% from October to November, whereas new apartment and townhome listings dropped 35%.

Pending gross sales fell by 14% for single-family houses and 6% for condos and townhomes. Closed gross sales declined 14% for single-family houses and 13% for condos and townhomes.

In lots of markets all through the state, together with Denver, practically half of the houses offered for lower than the asking value. Regardless of this development, the median gross sales value elevated by 5%, from $525,000 in November final 12 months to $550,000 final month.

Market modifications year-over-year

Common days on market elevated 25% from 53 days in November 2023 to 66 days final month. Out there months of stock elevated 10% from 3 months in November 2023 to three.3 months final month.

“We’re closing out 2024 with some very attention-grabbing market dynamics in Aurora,” stated Aurora-area realtor Sunny Banka.

“We proceed to have a robust market with listings, pendings, and solds all up in comparison with 2023. That will stand to motive provided that we now have extra houses for promote proper now in comparison with a 12 months in the past. As well as, our common days on market can also be up as are value reductions on listed houses.”

Consumers are slowly adjusting to increased costs and rates of interest, Moye stated.

“The present market continues to replicate a brand new regular, with no rapid return to the low rates of interest or residence costs of prior years,” she stated.

She stays optimistic for the approaching 12 months.

“As the brand new 12 months approaches, the market has the potential for a recent begin, providing a possibility for the primary and second quarters of 2025 to get better from the sluggish efficiency of 2024.”

The information and editorial staffs of The Denver Put up had no position on this put up’s preparation.