- The survey was carried out in January on the top of Bitcoin’s all-time excessive of $109,000

- 59% of institutional buyers are planning on allocating over 5% of belongings below administration to digital belongings

- An additional 75% mentioned they intend to put money into some type of tokenization by 2026

Institutional buyers stay bullish on crypto with 83% planning to increase their crypto publicity in 2025.

The analysis, which polled 352 institutional decision-makers in January, was carried out by Coinbase and EY-Parthenon.

It discovered that “greater than three-quarters of surveyed buyers anticipate to extend their allocations to digital belongings in 2025, with 59% planning to allocate over 5% of belongings below administration to digital belongings or associated merchandise.”

The survey, which was carried out on the top of Bitcoin’s all-time excessive of $109,000, discovered that almost 80% of buyers anticipate crypto costs to rise. Round 70% see crypto as the largest alternative to create engaging risk-adjusted returns.

Stablecoins and DeFi

Curiosity in stablecoins can be rising. 84% of establishments are already utilizing or planning to make use of stablecoins this 12 months, and 75% indicated that they intend to put money into some type of tokenization by 2026.

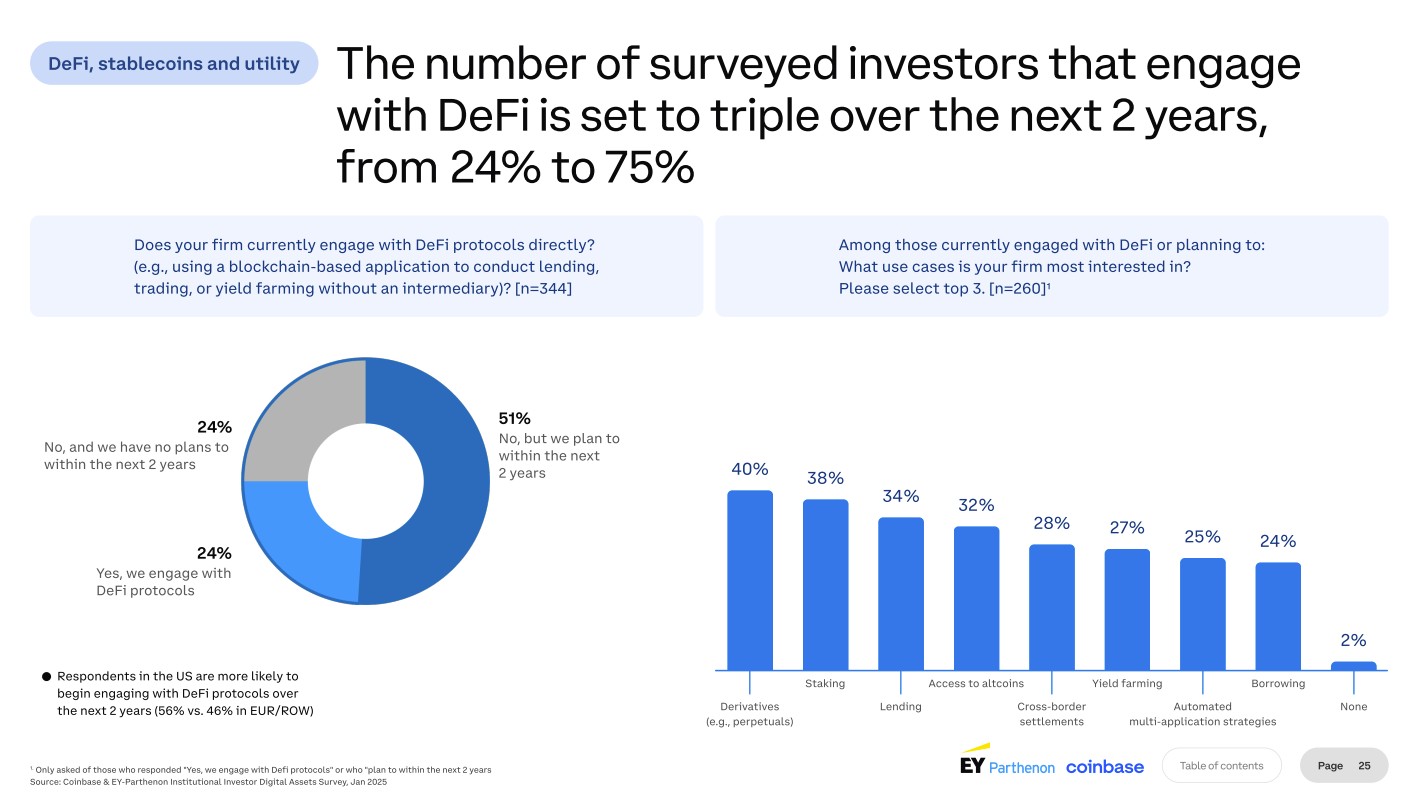

With decentralized finance (DeFi), the variety of buyers anticipated to interact with it’s set to rise from 24% to 75% over the following two years. But, regardless of the optimism the sector is projected to expertise, obstacles to DeFi embody regulatory (57%) and compliance (55%) considerations, along with a scarcity of inside information (51%), in response to the survey.

Amongst these presently engaged in DeFi or plan to, derivatives (40%), staking (38%), and lending (34%) are the highest three use circumstances corporations are eager about.

Bringing regulatory readability

Institutional buyers see regulation as the largest alternative and the largest threat for the crypto market in 2025.

In keeping with the survey, bringing extra regulatory readability round custody, tax remedy, and using stablecoins ought to introduce new market individuals and elevated exercise.

“We anticipate the optimistic tone and motion from each the brand new US administration and regulatory our bodies globally to speed up an already increasing curiosity in digital belongings,” the survey’s researchers mentioned.

Because the survey was carried out, crypto costs have declined. On the time of publishing, Bitcoin is buying and selling round $83,000. Earlier this month, Bitcoin fell to $76,000 after US President Donald Trump didn’t rule out a attainable recession.

The publish Coinbase survey: 83% of institutional buyers are planning to increase crypto publicity in 2025 appeared first on CoinJournal.