As Bitcoin dips under the $55,000 mark, the implications for cryptocurrency mining are fairly vital, elevating considerations throughout the business. Notably, the latest drop in Bitcoin’s worth has pushed the operational viability of many mining machines to their limits.

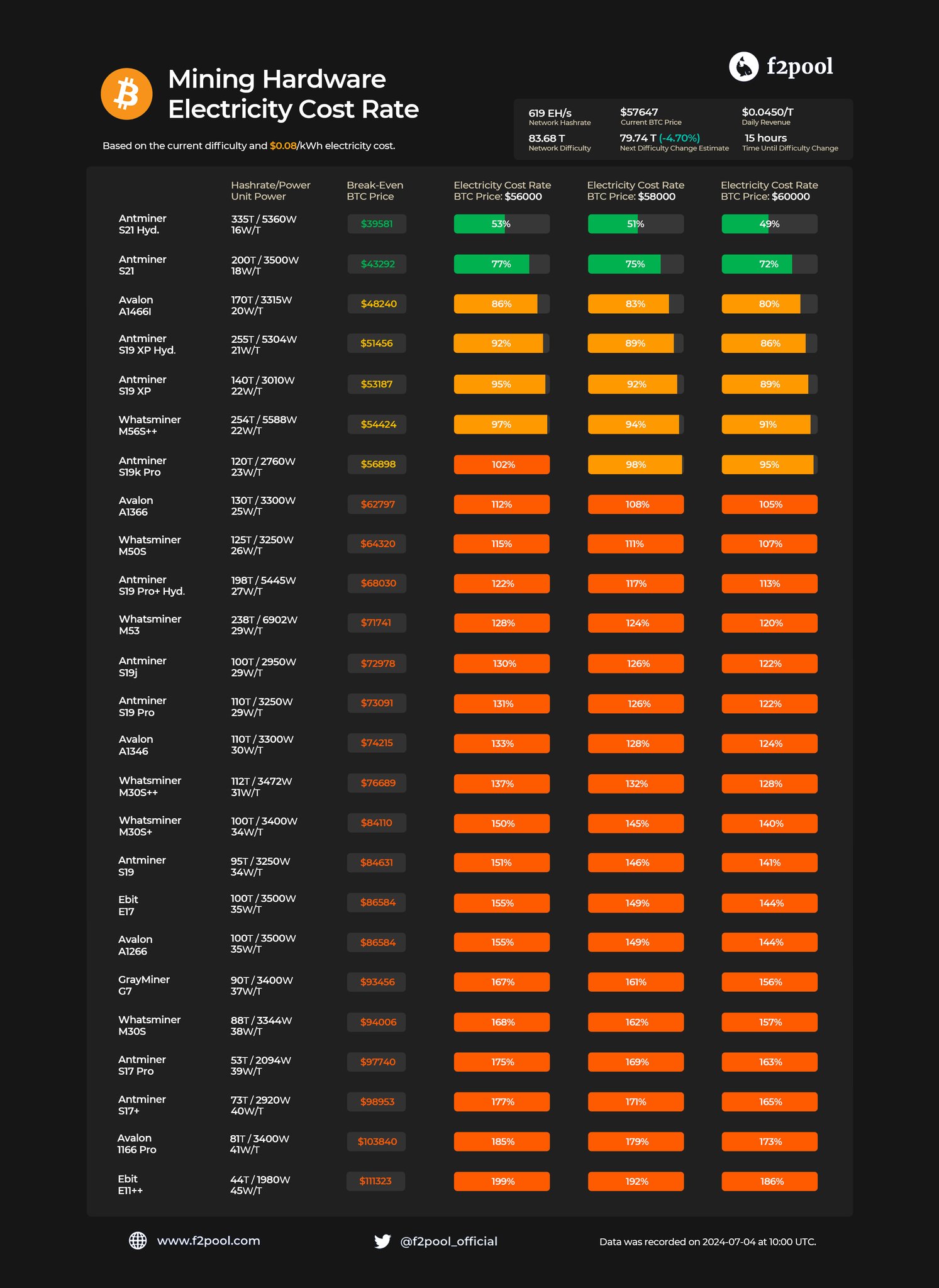

A report from F2Pool, a number one Bitcoin mining pool, highlights that of the various mining machines in the marketplace, solely a handful stay worthwhile beneath the present financial situations.

Adjusting to New Realities: Market Circumstances Pressure Miners

F2Pool’s evaluation reveals that simply 5 ASIC (Software-Particular Built-in Circuits) fashions can nonetheless revenue on the present Bitcoin value ranges. These embody the Antminer S21 Hydro, Antminer S21, Avalon A1466I, Antminer S19 XP Hydro, and Antminer S19 XP.

These machines have break-even factors starting from $39,581 to $53,187, making them the final bastions of profitability within the ongoing value dip.

However, fashions just like the Whatsminer M56S++ hover simply on the brink, with a break-even value dangerously near the present BTC value, emphasizing the slender margins inside which miners are working.

⛏️With #Bitcoin buying and selling under $58k, what’s the present profitability for mining?

At a charge of $0.08/kWh, ASICs much less environment friendly than 23 W/T function at a loss.

For extra particulars on mainstream miners, please consult with the desk under. pic.twitter.com/hJS1lsVnmK

— f2pool 🐟 (@f2pool_official) July 4, 2024

In the meantime, the BTC community displays these challenges with a notable lower in hashrate, a measure of the entire computational energy used to mine and course of transactions.

This discount could be attributed partly to much less environment friendly miners shutting down or downsizing their operations in response to lowered rewards following BTC’s newest Halving occasion, which noticed block rewards lower from 6.25 to three.125 BTC.

Friday witnessed a unfavourable problem adjustment of 5%, aimed toward making it simpler for the remaining miners to search out blocks. This adjustment may straight reply to the decreased competitors and assist stabilize mining revenues for these nonetheless within the recreation.

Regardless of these changes, the general profitability for miners stays pressured, with vital impacts seen not solely on particular person operations but additionally on the broader market.

Bitcoin Plummets 10%

BTC has skilled a pointy 10% decline previously week, falling to a present buying and selling value of $55,177. This vital drop has contributed to a 4.1% lower within the international crypto market cap, shedding over $100 billion over the previous day.

This downturn has closely impacted merchants, leading to widespread losses. Knowledge from Coinglass signifies that throughout the previous day, 207,067 merchants had been liquidated, resulting in complete liquidations of $580.18 million. BTC liquidations account for $186.99 million of this quantity, predominantly from lengthy positions.

Featured picture created with DALL-E, Chart from TradingView