Bitcoin is in focus, particularly now that the broader market is within the pink and a few sectors, principally meme cash, are sliding. Whilst BTC comes underneath immense promoting stress, on-chain information factors to power.

Over 1 Million Bitcoin Wholecoiners

Whereas the value struggles for traction, the variety of wholecoiners, or addresses with at the very least 1BTC, is trending larger, presently at report highs. Information from IntoTheBlock reveals that over 1 million distinctive addresses at the moment are holding a couple of BTC.

This spike is a big milestone that underscores the rising variety of people aiming for the wholecoiner standing. Of significance, nonetheless, it signifies that extra persons are internet bullish on the coin and keen to build up it and develop into wholecoiners.

At press time, Bitcoin stays uneven, although the general development from a top-down preview is bullish. As it’s, BTC is being influenced by a variety of basic components. Most of them embody the present financial uncertainty, with analysts intently monitoring information from the USA.

Though the USA Federal Reserve will slash rates of interest this 12 months, their choice to cut back it as soon as this 12 months, not twice or thrice as anticipated, is seen as bearish for BTC. Economists mentioned the central financial institution would flip dovish, reversing its place from 2022 to 2023 by decreasing rates of interest from present report highs.

For the reason that final assembly earlier this month, BTC costs have been edging decrease because the USD strengthens. The slide has been made worse by Mt. Gox trustees’ choice to compensate victims in July, not October as initially deliberate. On the similar time, the German and United States governments have been unloading the coin.

BTC Stays Uneven, Over $265 Billion Should Be Injected For Costs To Break All-Time Highs

One analyst notes that if BTC continues to drop, bulls, most of whom are leveraged, shall be liquidated ought to costs breach $60,000.

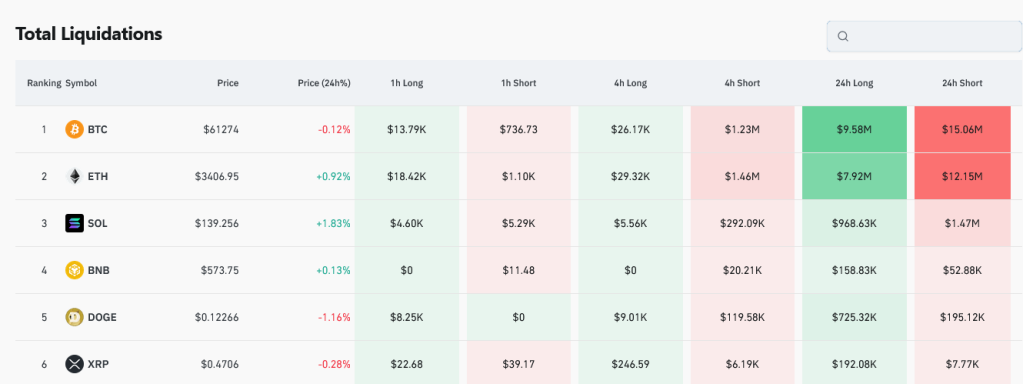

In response to Coinglass, as of June 27, over $9.5 million price of leveraged longs had been liquidated previously 24 hours. On the similar time, greater than $15 million of shorts had been forcefully closed.

Whether or not the present sideways motion will proceed within the brief time period stays to be seen. Technically, although costs are inside a broad vary, capped at round $74,000 on the higher finish and $56,000 on the decrease finish, the uptrend stays. Taking to X, one analyst mentioned that for BTC to surge and break $74,000, over $265 billion have to be injected into the market.

Characteristic picture from Canva, chart from TradingView