On-chain knowledge reveals the Bitcoin steadiness held by the short-term holders has jumped lately. Right here’s what this might imply for BTC’s worth.

Bitcoin Quick-Time period Holder Provide Has Registered An Uptick

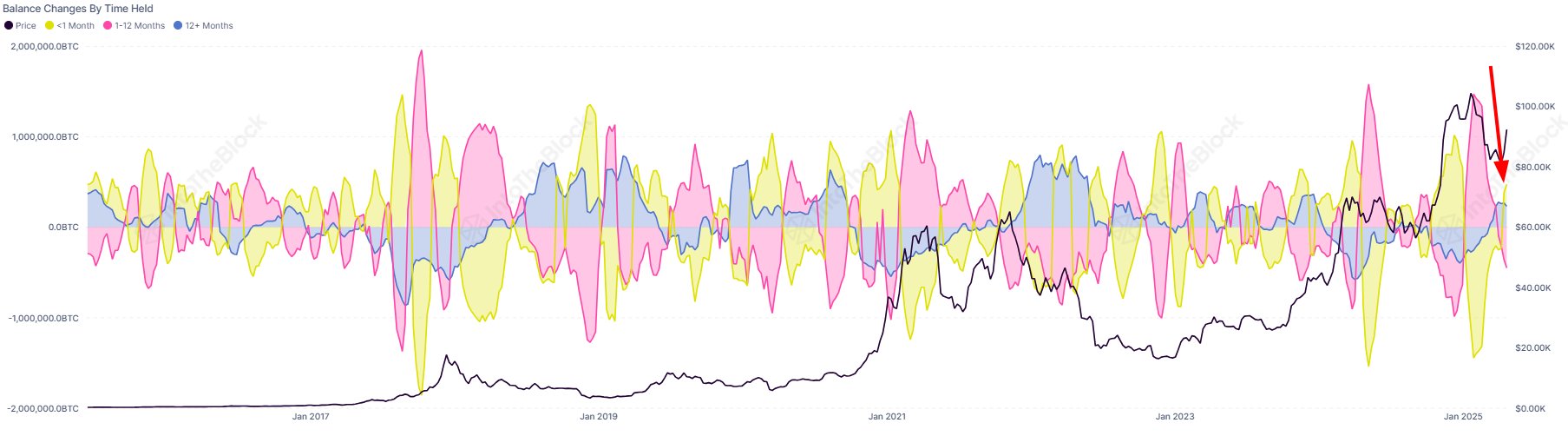

In a brand new publish on X, the market intelligence platform IntoTheBlock has talked about how the totally different Bitcoin cohorts have seen their provide change lately. The teams in query have been divided on the idea of holding time.

The analytics agency classifies the buyers into these teams: ‘merchants’ who bought their cash inside the previous month, ‘cruisers’ who did so between one and twelve months in the past, and ‘HODLers‘ who’ve been holding for greater than a yr.

Typically, the longer an investor holds onto their cash, the much less possible they’re to promote them sooner or later. Thus, the holder resolve will get stronger as one goes from the merchants to the HODLers.

Now, right here is the chart shared by IntoTheBlock that reveals the pattern within the web change of the steadiness held by every of those teams throughout the previous decade:

Seems to be just like the merchants have seen a optimistic change in current days | Supply: IntoTheBlock on X

As displayed within the above graph, the Bitcoin merchants have registered a optimistic worth on this metric lately, suggesting the steadiness held by the group has gone up. This improve for this cohort has come as BTC has been witnessing a worth rally.

Each time the provision of the merchants observes an increase, it means members of 1 or each of the older cohorts are breaking their dormancy. On condition that the most recent surge has coincided with an uplift within the asset’s worth, it’s potential that it’s a sign of profit-taking out there.

From the chart, it’s seen that the HODLers have additionally seen a optimistic change lately, implying these diamond palms are persevering with to carry tight. This leaves the cruisers as the one group that may be liable for the promoting, and certainly, the unfavourable steadiness change would affirm so.

The cruisers are extra resolute than the merchants, however even they are often vulnerable to panic promoting as they haven’t fairly achieved the identical stalwartness because the HODLers, so the most recent distribution from them is probably not too stunning.

Whereas the profit-taking is probably not a optimistic signal for Bitcoin, the rise within the dealer provide might be checked out from a extra bullish perspective: it might suggest there’s contemporary demand flowing into the sector.

This was seemingly the case again throughout the rally that occurred within the final couple of months of 2024, the place the dealer provide change spiked excessive into the optimistic territory.

“If this inflow persists, it helps the view that the present transfer is greater than a aid rally and might be the opening leg of a broader uptrend,” notes the analytics agency.

BTC Value

Bitcoin noticed a pullback beneath $93,000 yesterday, nevertheless it seems the coin has regained bullish momentum as its worth has now surged to $95,200.

The value of the coin appears to have shot up throughout the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.