On-chain knowledge reveals that long-term Bitcoin holders have seen their provide enhance lately regardless of the FUD going across the market.

Bitcoin HODLer Steadiness Has Registered An Enhance Not too long ago

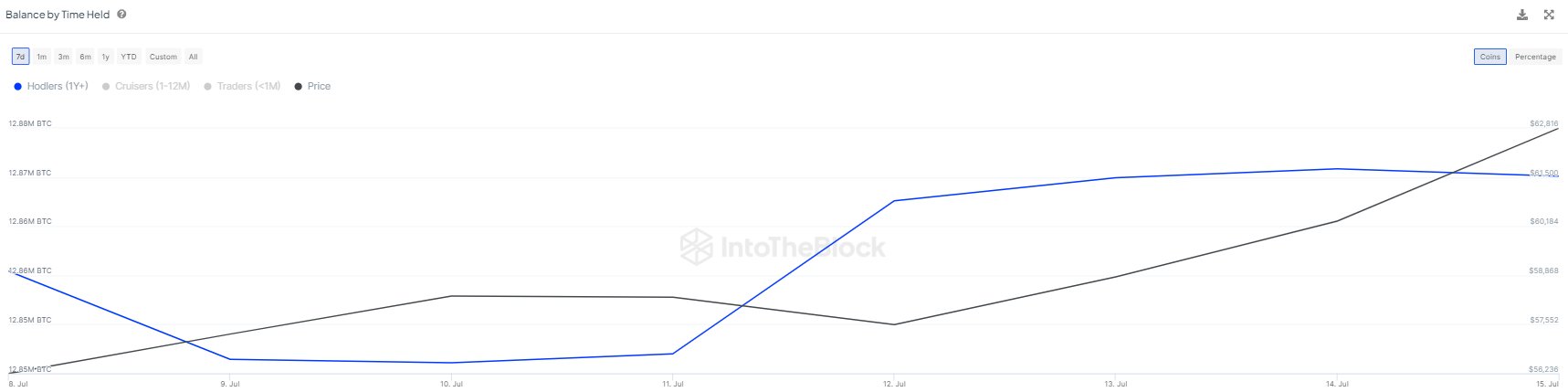

In accordance with knowledge from the market intelligence platform IntoTheBlock, the long-term holder provide has expanded lately. IntoTheBlock defines “long-term holders” (LTHs) or HODLers as these traders who’ve held onto their cash for no less than one 12 months.

Statistically, the longer a holder retains their cash dormant, the much less probably they turn into to promote them at any level. As such, the LTHs, which have a tendency to carry for comparatively lengthy durations, signify the cussed aspect of the market.

Whereas the short-term holders (STHs) would possibly simply promote throughout crashes or rallies, these diamond palms typically keep tight whatever the scenario within the sector.

Not too long ago, FUD has been going across the Bitcoin market because of the bankrupt cryptocurrency change Mt. Gox distributing cash again to their rightful house owners and the German Authorities promoting BTC it had confiscated.

Regardless of this, it might seem that the HODLers haven’t cared a lot, as their mixed steadiness has registered a rise over the previous week. The beneath chart reveals this improvement.

Appears to be like like the worth of the metric has seen a rise lately | Supply: IntoTheBlock on X

Keep in mind that any enhance within the Bitcoin LTH steadiness doesn’t imply that these HODLers are shopping for proper now. Moderately, it means that some shopping for occurred a 12 months in the past, and these cash have matured sufficient to turn into part of the cohort.

Promoting, nonetheless, does replicate instantly on the indicator, as cash see their age reset again to zero as quickly as they’re moved throughout the community, resulting in them now not being counted underneath the cohort.

As such, whereas this enhance within the metric doesn’t point out accumulation within the current, it does say that these traders who purchased a 12 months or extra in the past nonetheless really feel comfy in HODLing even in the course of the current market situations.

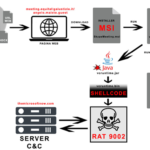

In another information, an analyst identified in a CryptoQuant Quicktake submit that the Coinbase Premium Hole has been optimistic lately. This metric retains observe of the distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

The worth of the metric seems to have seen an increase in current days | Supply: CryptoQuant

These optimistic indicator values recommend that Coinbase is now observing a better shopping for stress than Binance. The platform is thought to be the popular possibility of American institutional traders, so it’s potential that the shopping for from these massive entities is driving the restoration.

BTC Value

Bitcoin is again above the $64,400 stage after seeing a greater than 12% surge during the last seven days.

The worth of the coin seems to have been going up over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, IntoTheBlock.com, chart from TradingView.com