Picture supply: Getty Pictures

Burberry Group (LSE: BRBY) shares lately hit a 14-year low. They’re down 72% in 15 months! When FTSE 100 shares are distressed like this, it’s at all times price looking.

In any case, Rolls-Royce inventory had plummeted greater than 80% previous to its turnaround, whereas Nvidia tumbled round 60% on the Nasdaq earlier than ChatGPT was launched.

So may Burberry shares now be in bargain-basement territory? Let’s have a look.

Worrying traits

On 15 July, the posh trend home reported a horrible first quarter for the 13 weeks to 29 June. Retail income plunged 22% 12 months on 12 months to £458m, with comparable retailer gross sales down 21%.

It stated the weak point had continued into July and if it persists, it may even lead to a H1 working loss.

Wanting forward, it expects wholesale income to say no by round 30% for the total 12 months. In the meantime, the dividend was axed and a fourth CEO in a decade has are available.

An aesthetic fake pas

Presently, the inventory’s buying and selling on a price-to-sales (P/S) ratio of 0.87. That appears too low at first look, even when annual gross sales are set to fall.

However, a few issues fear me right here. The primary is that Q1 gross sales fell in each single market (besides Japan) the place Burberry operates. So this isn’t only a China situation.

| Location | Comparable retailer gross sales |

| Mainland China | -21% |

| South Asia Pacific | -38% |

| South Korea | -26% |

| Europe, Center East, India, and Africa | -16% |

| Americas | -23% |

Second, Chairman Gerry Murphy stated on the Q1 convention name that the agency had “maybe moved too far too quick with a brand new aesthetic”. That’s the model’s transfer additional upmarket with a brand new type below chief inventive officer Daniel Lee throughout a luxurious sector downturn hasn’t labored.

But he additionally stated there will likely be no main technique shift: “We’re attempting to be a common model… we do have to reposition, I assume, again to our core, to some extent, however it’s an adjustment, not a reversal of technique”.

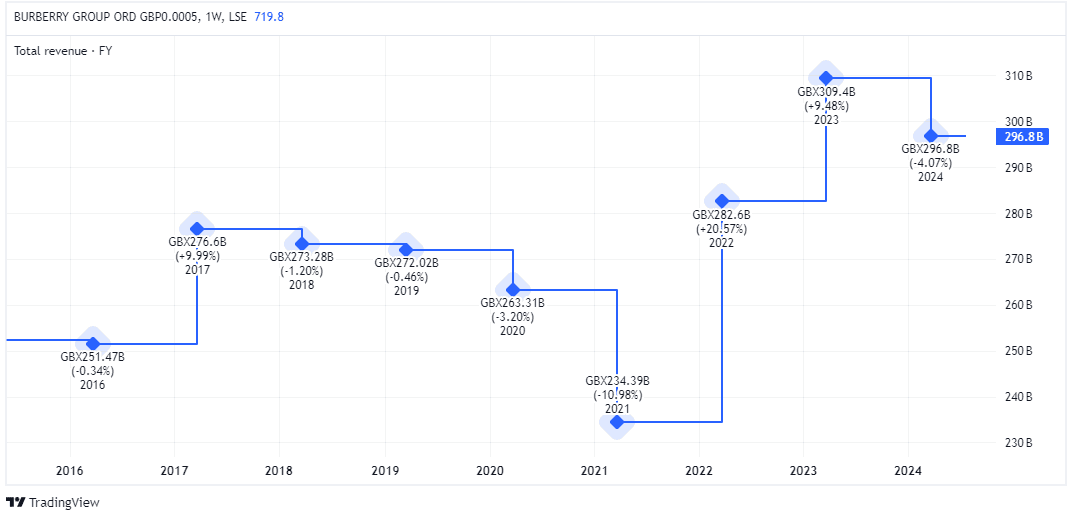

In FY15, income was £2.52bn. In FY25, it’s forecast to be £2.61bn, down from £2.97bn final 12 months. That’s disappointing development for a worldwide luxurious trend model. I concern greater than an adjustment could also be wanted.

My transfer

Wall Avenue legend Peter Lynch stated: “Don’t purchase ‘low-cost’ shares simply because they’re low-cost. Purchase them as a result of the basics are bettering.”

This is the reason I invested in Rolls-Royce shares at 149p regardless of them nonetheless being down lots. I assumed the corporate’s fundamentals have been bettering and this might in the end drive the share worth greater.

In different circumstances, I’ll put money into an organization if the basics aren’t essentially bettering however there’s substantial earnings on provide. For instance, British American Tobacco inventory’s dust low-cost because the agency offers with falling cigarette volumes. However the sweetener is the large 9% dividend yield it carries.

In Burberry’s case, neither of these items apply. The corporate’s monetary outlook is weakening whereas there’s no dividend to cushion the blow. And whereas the brand new CEO may pep issues up, I discover the excessive govt turnover a turnoff.

With its market-cap now at £2.77bn and heading for the FTSE 250, I feel Burberry may change into an acquisition goal. Nevertheless, I don’t make investments hoping for takeover bids.

All issues thought-about, I’d moderately goal different FTSE 100 shares proper now.