Colorado owners really feel the pinch as house insurance coverage prices preserve climbing.

In response to an Insurify report, premiums will soar by about 11% this yr, with the typical annual premium hitting $6,630.

Rising prices make it more and more difficult for owners to safe reasonably priced protection.

In response to a ValuePenguin survey:

- In 2024, two-thirds of house owners skilled elevated insurance coverage premiums, with 25% of their insurers dropping them.

- 50% of house owners fear about their houses turning into uninsurable.

- 44% discover house insurance coverage tougher to afford than in earlier years, and 75% anticipate charge hikes in 2025.

- 58% shopped for insurance coverage, saving a mean of $1,034 yearly, whereas 56% saved a mean of $781 by asking for reductions.

- 34% diminished their protection to save cash, and 31% thought-about dropping house insurance coverage completely to self-insure.

Owners with out insurance coverage soar

Regardless of the dangers illustrated by California’s wildfires, a LendingTree research exhibits thousands and thousands of house owners stay uninsured.

Key findings embody:

- Almost one in seven houses within the U.S. is uninsured, totaling 11.3 million out of 82.9 million owner-occupied houses (13.6%).

- Roughly 10% of houses in Colorado are uninsured.

- House insurance coverage charges in Colorado jumped 76.6% over the past six years.

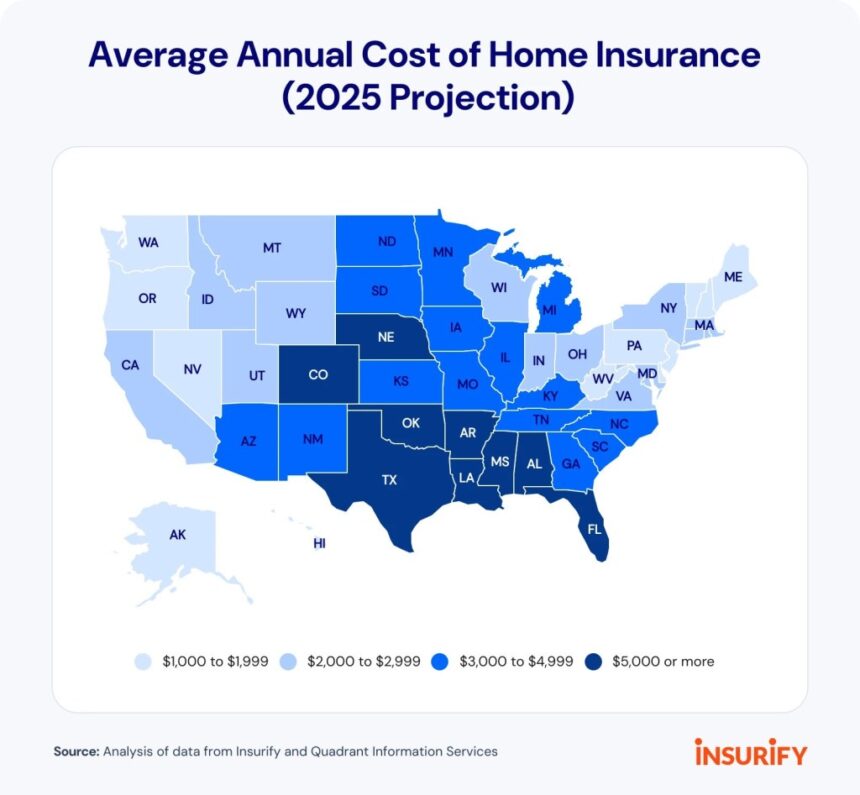

- In 2025, the typical Colorado owners’ insurance coverage coverage prices $3,331 per yr for $350,000 of dwelling protection, which is 55% costlier than the nationwide common of $2,151 per yr.

- Colorado has larger house insurance coverage charges than neighboring states. House insurance coverage is cheaper in Arizona ($1,993/yr) and Nevada ($1,350/yr). In Nebraska, charges are costlier, at $4,370 per yr.

- The place you reside in Colorado additionally impacts house insurance coverage premiums. Lamar is the most expensive, with a mean annual value of $4,864, whereas the most cost effective, Fruitvale, has a mean charge of $1,550.

- In Denver, house insurance coverage prices $4,002 yearly, or 20% above the state common. In Colorado Springs, the state’s second-largest metropolis, you’ll pay $4,248 per yr on common.

Colorado works for a repair

Colorado is working to decrease home-owner insurance coverage prices by including a 1% coverage payment. That might enhance the typical annual value by about $32 however in the end enhance competitors, improve home-owner protections, and decrease premiums.

The payment would fund state applications to deal with hail harm and wildfire danger to maintain insurance coverage firms from leaving the state.

The Colorado legislature is contemplating two payments to boost owners’ insurance coverage accessibility:

Home Invoice 1302 would create two boards that levy a 0.5% premium payment to fund a reinsurance program for wildfire losses and a grant program for hail-resistant roofs.

Home Invoice 1182 goals to control insurance coverage firms’ use of danger evaluation fashions. It might require firms to tell prospects of their wildfire danger scores and counsel methods to decrease these scores and prices.

The information and editorial staffs of The Denver Publish had no function on this publish’s preparation.