The most recent report from CoinShares, a number one digital asset funding agency, reveals that final week’s efficiency for crypto asset funding merchandise was blended.

Based on the report, the market skilled inflows totaling $308 million, marking a continuation of constructive developments. Nevertheless, there was additionally a sequence of outflows that amounted to roughly $1 billion.

Deciphering The Fund Flows

The info shared by CoinShares highlighted substantial outflows, with December 19 witnessing a single-day outflow of $576 million. The ultimate two days of the week contributed an extra $1 billion in whole outflows, elevating considerations amongst market members about sustained investor sentiment.

James Butterfill, Head of Analysis at CoinShares, defined that these outflows “coincided with a value correction” and “adopted the hawkish outlook” offered by the Federal Reserve throughout its Federal Open Market Committee (FOMC) assembly.

Based on Butterfill, the market reacted to the revised “dot plot,” which steered potential future rate of interest hikes. Regardless of these notable outflows, the cumulative affect on whole belongings beneath administration (AuM) was comparatively minor, equating to simply 0.37% of whole AuM.

Butterfill additional famous that this occasion ranks because the thirteenth largest single-day outflow recorded, with probably the most important outflow occurring in mid-2022 after the same FOMC announcement.

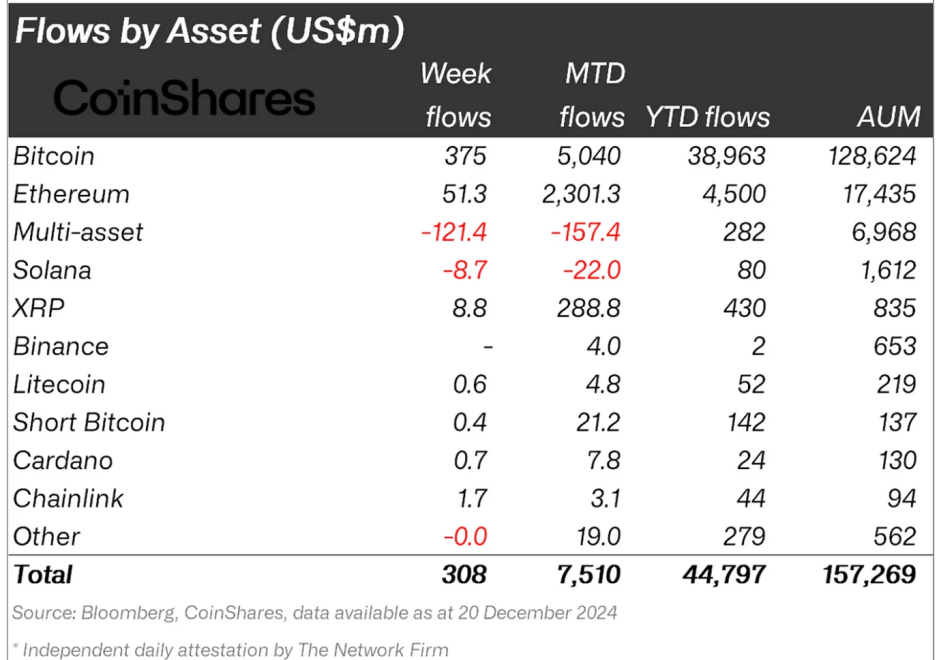

Whereas the headline numbers counsel market warning, Bitcoin (BTC) confirmed resilience, managing web inflows of $375 million regardless of intra-week volatility. Notably, quick Bitcoin merchandise noticed minimal exercise, indicating continued investor confidence in Bitcoin’s long-term potential.

Altcoins and Multi-Asset Funding Traits

The report additional revealed the contrasting performances between varied altcoins and multi-asset funding merchandise. Significantly, outflows from multi-asset funds had been fairly important hitting $121 million, as traders took a extra selective, asset-specific method.

Such habits signifies traders have gotten pickier and concentrating on belongings with firmer fundamentals and the potential to develop. Ethereum (ETH) remained a distinguished performer, securing $51 million in inflows over the week.

These inflows reaffirm Ethereum’s place as a key participant within the digital asset house, pushed by sustained institutional curiosity and optimism surrounding its technological upgrades.

Nevertheless, not all main altcoins shared this constructive momentum. Butterfill reveals that Solana (SOL) skilled $8.7 million in outflows, contrasting sharply with Ethereum’s constructive motion.

It’s value noting that the discrepancy suggests a divergence in investor sentiment between these two main belongings, doubtlessly influenced by ongoing ecosystem developments and perceived dangers.

In distinction, following ETH, XRP emerged as one of many standout altcoin performers, recording $8.8 million in inflows. Equally, Horizen (ZEN) and Polkadot (DOT) reported inflows of $4.8 million and $1.9 million, respectively, highlighting a desire for particular altcoins regardless of broader market volatility.

These inflows counsel continued investor confidence within the long-term potential of choose blockchain ecosystems, even amid short-term corrections.

Featured picture created with DALL-E, Chart from TradingView