On-chain knowledge reveals the Bitcoin long-term holder provide has continued declining not too long ago. Right here’s what this might imply for the asset.

Bitcoin Lengthy-Time period Holder Provide 30-Day Change Has Been Unfavorable Lately

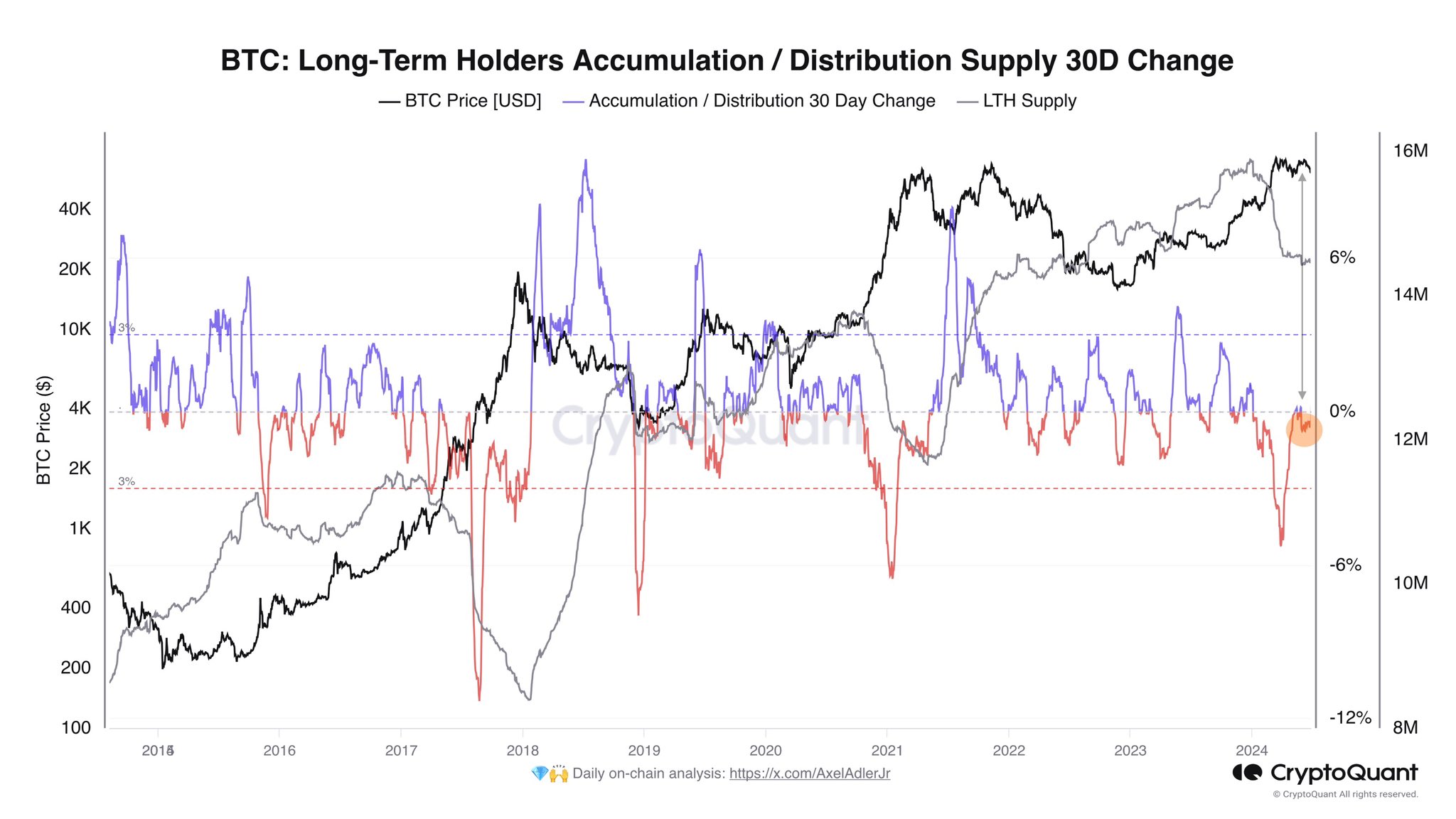

As defined by CryptoQuant writer Axel Adler Jr in a put up on X, the BTC long-term holder provide hasn’t been displaying any indicators of development not too long ago. The “long-term holders” (LTHs) check with the Bitcoin buyers who’ve held onto their cash for over 155 days.

The LTHs comprise one of many two primary divisions of the BTC market primarily based on holding time, with the opposite cohorts being referred to as the “short-term holders” (STHs).

Statistically, the longer an investor holds onto their cash, the much less doubtless they develop into to promote them at any level. As such, the LTHs are thought of the cussed a part of the sector, whereas the STHs embody the fickle-minded buyers.

Regardless of their resilience, the Bitcoin LTHs have not too long ago participated in a selloff. Beneath is a chart that reveals the pattern within the complete provide held by these HODLers and its 30-day change over the previous decade.

The worth of the metric appears to have been damaging in latest weeks | Supply: @AxelAdlerJr on X

The above graph reveals that the Bitcoin LTH Provide has been down because the spot exchange-traded funds (ETFs) obtained approval from the US Securities and Trade Fee (SEC) in January.

From the chart of the 30-day change, it’s obvious that the plunge within the metric was the sharpest when the rally in direction of the brand new value all-time excessive (ATH) had occurred.

These diamond fingers maintain their cash for lengthy intervals and have a tendency to build up giant positive aspects. The timing of the selloff would point out that these earnings had ballooned a lot in the course of the rally that even these diamond fingers gave into the attract of profit-taking.

Regardless of the bearish value motion the cryptocurrency has been going by not too long ago, the indicator has continued to maneuver down, though the decline has been a lot much less steep.

The continued drawdown is much more fascinating as a result of the spot ETF approval launch is now older than 155 days. It will appear that no matter shopping for from the HODLers occurred again then is at the moment being negated by recent promoting from older cohort members.

Axel notes that the dearth of development within the LTH provide might indicate the presence of market-wide pessimism. Because the graph reveals, this isn’t one thing new on this cycle.

It will seem that the Bitcoin LTHs additionally participated in selloffs in the course of the final two bull runs. Thus, the latest distribution from the LTHs could not essentially be a nasty register the long run.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $61,200, down greater than 4% over the previous week.

Appears like the value of the coin has been taking place over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com