Picture supply: Getty Pictures

The FTSE 100 is filled with sensible worth shares proper now. If I had money to speculate, listed here are three I’d purchase earlier than the market wises as much as their cheapness.

Customary Chartered

Asia-focused banks like Customary Chartered (LSE:STAN) face near-term uncertainty as China’s economic system toils. But on steadiness I consider the corporate (like business rival HSBC) has supreme funding potential because of beneficial demographic tendencies.

A mix of regular inhabitants development and booming private wealth means demand for its wealth administration, and retail and funding banking companies, is hovering. These helped fixed foreign money revenues surge 20% within the first three months of 2024.

As we speak Customary Chartered shares commerce on a rock-bottom price-to-earnings (P/E) ratio of 6.3 occasions. This makes it one of many least expensive banks on the Footsie right now.

However this isn’t the one metric that means it may very well be a prime worth inventory right now.

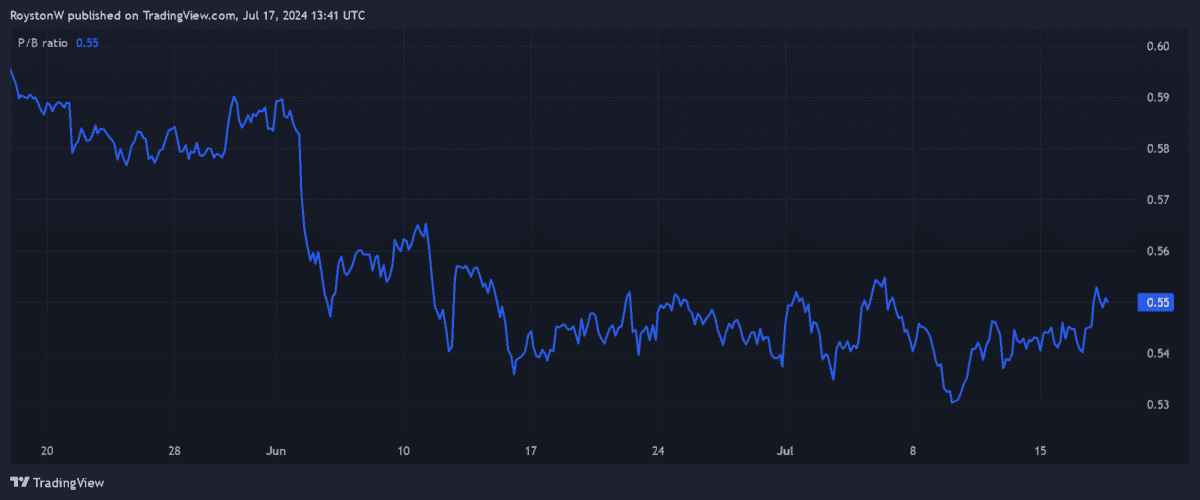

At 732.6p per share, the financial institution additionally boasts an extremely low price-to-book (P/B) ratio of round 0.6. At under one, this means that it trades at a reduction to the worth of its property.

WPP

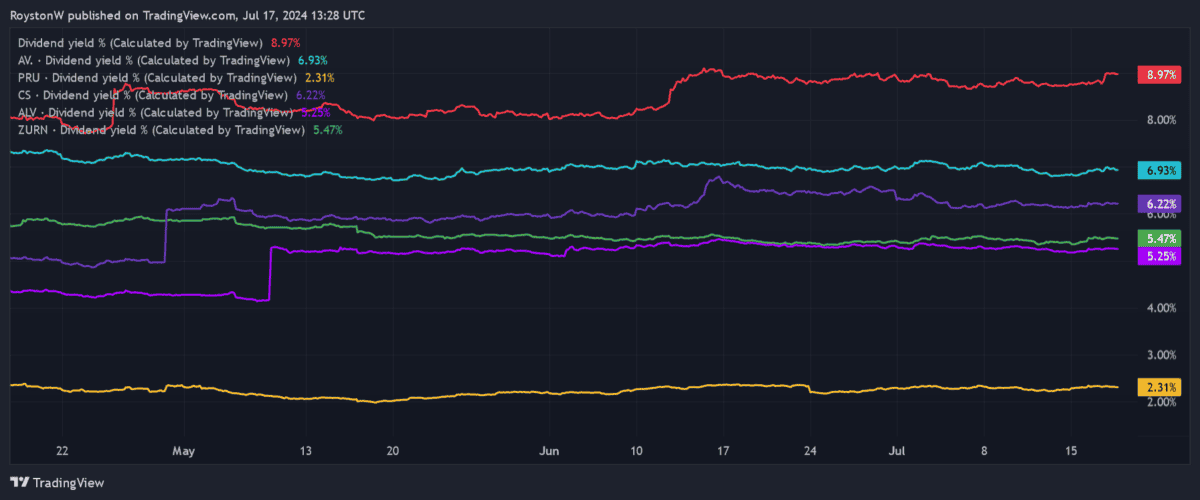

Communications large WPP (LSE:WPP) additionally gives distinctive all-round worth at 725.8p per share. It trades on a P/E ratio of 8.2 occasions for this 12 months. In the meantime, its dividend yield clocks in at a chunky 5.3%.

Promoting spending is without doubt one of the first issues that firms lower when occasions are robust. Present difficulties meant that WPP’s personal internet revenues dropped 1.6% on a like-for-like foundation in the course of the first quarter.

Nonetheless, I consider these present troubles are baked into the FTSE 100’s low valuation. It’s additionally my perception that revenues right here might rebound strongly as soon as the financial cycle improves, helped by its big publicity to growing markets.

I additionally suppose WPP’s large funding in digital promoting and synthetic intelligence will repay handsomely.

Authorized & Basic

Authorized & Basic Group‘s (LSE:LGEN) share value is tumbling sharply. Traders have given the agency’s plan to develop dividends at a slower fee a giant thumbs down. What’s extra, issues that rates of interest might stay longer than initially anticipated have pulled its shares decrease.

For my part, this represents a beautiful shopping for alternative. Asset managers like this will likely wrestle within the close to time period if central banks fail to meaningfully lower charges. However Authorized & Basic has appreciable development potential over the long run as demand for retirement and wealth merchandise steadily takes off.

I additionally consider the market has massively overreacted to the corporate’s contemporary dividend coverage. Its big dividends are nonetheless anticipated to develop 2% between 2025 and 2027. And the Footsie agency plans to complement a rising dividend with additional substantial share buybacks.

At 226.8p, Authorized & Basic shares commerce on a ahead price-to-earnings development (PEG) ratio of 0.1. A studying under one signifies {that a} inventory is undervalued.

What’s extra, its gigantic 9% dividend yield beats these of its FTSE 100 rivals by an enormous margin. I feel it’s one other sensible worth inventory to contemplate.